Where do you want to live after you’ve reached financial independence? For many people, where they live is dictated by their career. That restraint ends once you have built your net worth and no longer need to work for a living. Do you want to live near the ocean or in a busy metropolitan area with lots of things to do?

The question of where to live in retirement is a very personal decision and the right answer will depend on many factors. Nearly 570,000 seniors moved to a different state last year and 38% of retirees reported they have moved at least once since they left employment. Financial implications are not necessarily the most important factor but they do weigh heavily. Most reports published on the best places to retire give a heavy weighting to affordability. Other important considerations are access to healthcare, climate, and culture.

I was curious to see how my home state of Pennsylvania fared in some of the rankings among the best states to retire. MoneyWise compiled annual studies by Bankrate, WalletHub and Kiplinger to create a best of the best list of states for retirement. Pennsylvania ranked number 14 in this compilation. They cited our livable four-season climate with warm summers, a pleasant fall and a genuine winter. While Pennsylvania is not on a coastline, it does offer easy access to beaches and lakes, plus mountains and busy cities’ many cultural activities.

Pennsylvania always ranks high for retiree health care. The MoneyWise article noted top-notch health care in Philadelphia. A recent study on best places in the country to retire for your health ranked Lancaster, PA number 10. The study noted Penn Medicine’s ownership of Lancaster General Health, the University of Pittsburgh Medical System’s Pinnacle Health presence in the county and Penn State Health’s location in Hershey.

SmartAsset says Pennsylvania is a tax-friendly state for retirees. The article notes the following reasons for the rating:

- Social Security income is not taxed.

- Withdrawals from retirement accounts are not taxed.

- Public and private pension income are not taxed.

- Wages are taxed at a flat rate of 3.07%.

- The state sales tax at 6.0% is among the 20 lowest in the country.

SmartAsset offers an easy-to-use online calculator to estimate your tax liability if you were a retiree in Pennsylvania.

RetirementLiving ranks Pennsylvania sixth on its list of the most tax-friendly states during retirement. RetirementLiving also noted the tax advantages mentioned earlier. The negatives noted in their article were the state’s inheritance tax of 4.5% to lineal descendants, 76¢ per gallon gas tax, and real estate taxes.

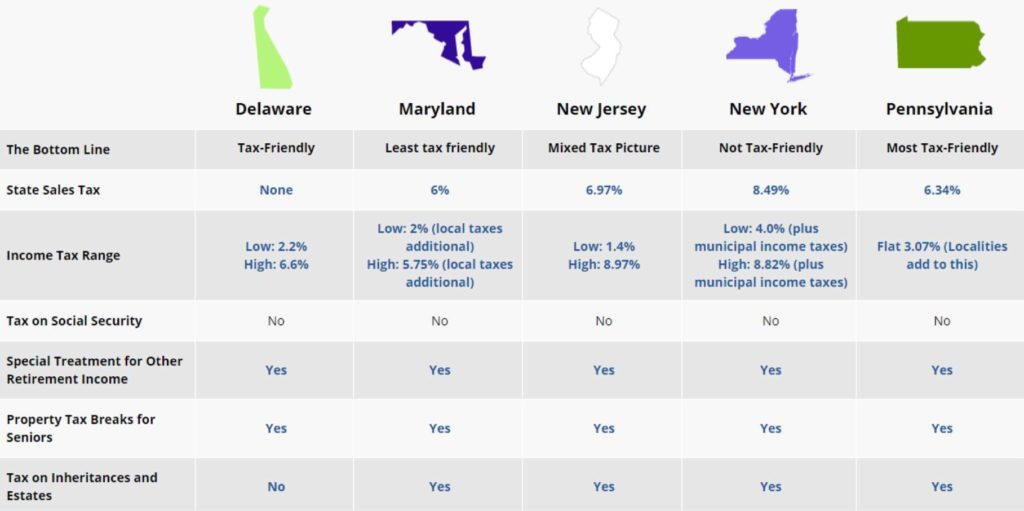

Kiplinger provides a very helpful State-by-State guide to taxes for retirees. Their site allows you to compare up to five states side-by-side. I used this resource to compare states that surround Pennsylvania.

Source: Kiplinger State-by-State Guide to Taxes on Retirees

New Jersey’s tax friendliness is listed as a mixed picture because the state has been taking steps to reduce taxes on retirees. The state does not tax Social Security benefits or military pensions. A2016 law gives seniors the opportunity to qualify for an exclusion of their retirement income from state income taxes. By 2020, joint filers may be able to exclude income of $100,000 from state income taxes. The state is also phasing out its estate tax. Unfortunately, New Jersey has the highest real estate taxes in the country.

Maryland doesn’t tax Social Security benefits and allows filers age 65 or older an exclusion of up to $30,600 on distributions from 401(k), 403(b) and 457 plans, along with income from public and private pensions. However, income above the exclusions will be heavily taxed. There is the state income tax (which has a top rate of 5.75%) plus Maryland’s 23 counties and Baltimore City may levy additional income taxes ranging from 1.75% to 3.20% of taxable income.

Bankrate.com ranked Maryland as the worst state to retire in 2019. Bankrate noted the following reasons for the rating:

- Affordability – 4th worst

- Culture – 9th worst

- Wellness – tied for 13th worst with Washington

- Crime – 18th worst

Delaware exempts Social Security benefits from tax. Taxpayers over age 60 can exclude $12,500 of investment and qualified pension income from state income taxes. Above the exclusion, the state income tax is applied in a range from 2.2% (on taxable income of $2,001 to $5,000) and 6.6% (on taxable income above $60,000). Taxpayers who are 65 or older on December 31 are eligible for an additional standard deduction of $2,500 (if they do not itemize). There is a property tax credit of up to $400 for homeowners age 65 and older. Unfortunately, anyone who moved to Delaware after January 1, 2018, cannot receive the credit until they have lived in the state for ten consecutive years.

Many clients have told me the most important criteria for them is to live close to the people they love and care about. Before you decide to move, consider all the things that are important to you—costs of living, better healthcare, and friendlier tax laws, etc.—are just some of the things to consider for your happiness. Click here to read Rick’s original post.

Rick’s Tips:

- Surveys report that more than a third of seniors move to another state sometime after retirement.

- Affordability, access to healthcare, climate, and culture are just some of the important factors to consider before moving to another state.

- Taxes—income tax, sales tax, property tax—can have a huge impact on the affordability of one state over another.

By Rick Rodgers

Read more from Rick Rodgers by clicking here to purchase his book.

Don’t Retire Broke:

Don’t Retire Broke:

An Indispensable Guide to Tax-Efficient Retirement Planning and Financial Freedom, by Rick Rodgers

Using easy-to-understand language and real life examples, Rick teaches you how to avoid savings pitfalls and costly tax mistakes – many you may not even know about – so you can enjoy the retirement lifestyle you want.