One of the most important retirement planning decisions to make will be deciding when to draw Social Security benefits. It is a difficult decision in general because there are a lot of factors to consider. This newsletter will look at three important factors to think about when taking Social Security benefits.

1. Marital Status

Are you married, divorced, single, or widowed? Many people approach this decision as if they were single. In order to maximize benefits, the decision should be viewed jointly even if your spouse is no longer living or you are no longer married.

The full spousal benefit could be up to 50% of the partner’s full retirement age (FRA) amount if taken at FRA. The spousal benefit is usually favorable for nonworking spouses or spouses who had lower incomes for many years. An individual may file for spousal benefits as early as age 62 but will receive a permanently reduced benefit amount for life if they file early. To receive spousal benefits, the spouse must be receiving his or her retirement benefits (except for divorced spouses). One could begin drawing their benefit at age 62 and then switch to the spousal benefit once their spouse begins drawing benefits. However, their spousal benefit would be less than 50% of the worker’s amount because they started drawing early. An individual could also claim survivor’s benefits on a deceased spouse’s earnings record. Reduced benefits can be taken as early as age 60 for widows or widowers.

It is important to think about joint life expectancy when married couples are planning to draw benefits. The goal will be to maximize the benefit of the highest earner because that will become the survivor benefit.

Widowed

Upon the death of the first spouse, the survivor will get the higher of the two benefit amounts. It is generally advisable to have the person with the higher benefit amount wait until at least FRA to start their benefit. This maximizes lifetime cumulative benefits for a couple where one spouse may expect to outlive the other. This is similar to choosing the survivorship option when drawing a pension.

If a deceased worker started receiving reduced retirement benefits before FRA, a special rule called the retirement insurance benefit limit may apply. The retirement insurance benefit limit is the higher of:

- The reduced monthly retirement benefit to which the deceased spouse would have been entitled if they had lived, or

- 82.5% of the unreduced deceased spouse’s monthly benefit if they had started receiving benefits at their FRA.

Married: The Lower Earner

The lower earner should generally wait until their FRA to draw benefits. They could begin drawing their own benefit until their spouse starts drawing benefits, and then switch to spousal benefits if the amount is higher. A retiree claiming benefits based on their own record, can put off receiving benefits after FRA in exchange for “delayed retirement credits.” Benefits continue to increase each month up until age 70. However, spousal benefits do not increase after FRA. There is no financial benefit to a lower earning spouse if he or she waits past FRA to claim Social Security.

Keep in mind that claiming Social Security benefits before FRA results in a permanent reduction in the benefit amount whether you are claiming spousal benefits or your own. Claiming benefits at the earliest possible age of 62 can reduce benefit amounts by as much as 32.5%.

2. Fully Retired vs. Working Part-Time

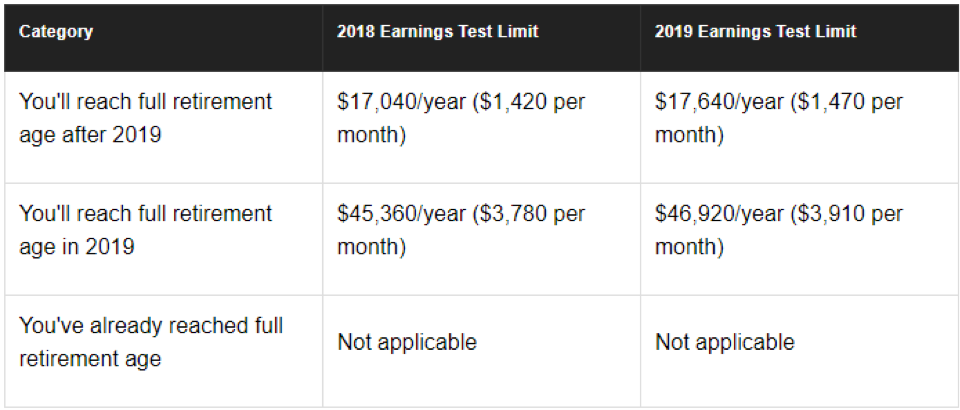

In addition to a reduced benefit when drawing early, there is also an earnings test that penalizes benefits for someone who is still working. The earnings test applies to earned income (wages or self-employment income) not investment income or retirement income. Social Security benefits will be reduced if total earnings exceed the annual limit:

Source: SSA.gov

If you’ll reach FRA after 2019, $1 of your benefits will be withheld for every $2 in excess earnings. If you’ll attain FRA during 2019, $1 of your benefits will be withheld for every $3 in excess earnings, and only earnings in the months before your birth month will be considered.

3. Income Taxes

Finally, an important part of an effective Social Security strategy should consider tax implications. Up to 85% of benefits could be taxed, depending on the retiree’s other income. Despite inflation, the income levels for taxing Social Security benefits haven’t changed for decades. Less than 10% of retirees paid federal income tax on their benefits the first year Social Security became taxable. Today, about 40% pay tax on some portion of their benefits, and that’s expected to climb to over 50% in three decades.

An effective drawing strategy might include delaying benefits in order to make Roth conversions before age 70. Required minimum distributions at age 70 ½ could make a large portion of Social Security benefits subject to tax. Having the IRA converted to a Roth before drawing benefits could minimize taxation of Social Security while also maximizing delayed retirement credits.

Social Security benefits should play a role in your retirement plan, but they shouldn’t be the only method of funding your retirement. At Rodgers & Associates, our financial planners take a look at the entire picture: taxes, investments, risk management, and more. It’s the coordination of many aspects of your financial plan that helps us take advantage of opportunities.

You can visit the original article on Rick’s website here.

Rick’s Tips:

- Couples should devise a claiming strategy to maximize Social Security benefits over their joint life expectancy.

- The spouse with the lower earning history should generally wait

until their FRA to begin drawing benefits.

- An effective Social Security strategy should consider tax implications.

Learn more by reading Rick’s book. You can purchase it here or by clicking the book.

Don’t Retire Broke:

Don’t Retire Broke:

An Indispensable Guide to Tax-Efficient Retirement Planning and Financial Freedom, by Rick Rodgers

Using easy-to-understand language and real life examples, Rick teaches you how to avoid savings pitfalls and costly tax mistakes – many you may not even know about – so you can enjoy the retirement lifestyle you want.