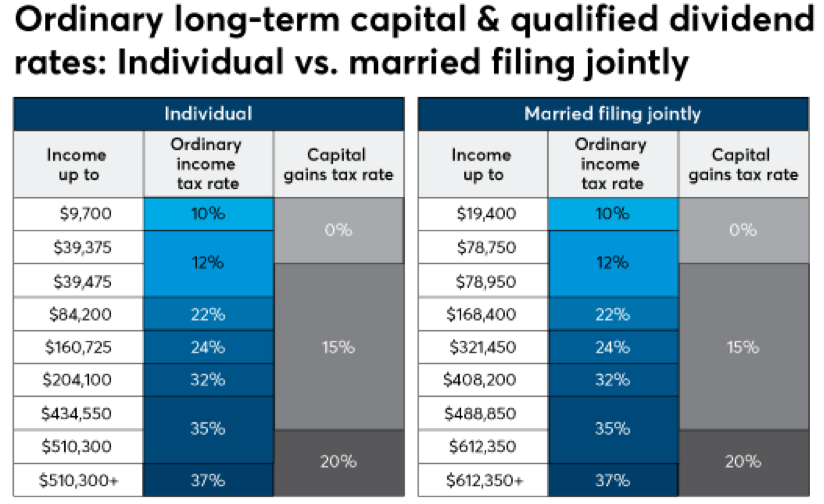

Long-term capital gains and qualified dividends have retained their preferential tax treatment following the Tax Cuts and Jobs Act of 2017 (TCJA). Tax rates for both types of income range from 0% for taxpayers in the lowest tax brackets to 20% for the top income earners. This compares to tax rates on ordinary income, which scale from 10% to 37%.

Source: Michael Kitces (www.kitces.com)

Managing an investment portfolio efficiently requires knowledge of income taxes and your tax bracket specifically. Investors think they are being savvy by holding onto a stock and not paying capital gains tax; however, if a stock position is underperforming, they could be losing more in underperformance than they would pay in tax on the capital gain.

Investors in this position should begin by projecting their taxable income to determine their tax bracket. Taxable income can be found on line 10 of the 2018 Form 1040. A married taxpayer filing jointly with taxable income under $79,000 could realize some long-term capital gains without paying any federal tax. Taxpayers need to keep in mind they may pay state income tax on the gains depending on what state they live in.

If You’re a Taxpayer in the Top Tax Brackets

Taxpayers with higher taxable income will pay some federal tax but at a lower rate than ordinary income. These taxpayers will need to pay attention to the 3.8% Medicare surtax on net investment income. Net investment income obviously includes long-term capital gains and qualified dividends. The income brackets for this tax has its own thresholds of $200,000 for individuals and $250,000 for married couples. This threshold is based on adjusted gross income (AGI is found on line 7 of the 2018 Form 1040) and not on taxable income. Adding this tax to the equation means there are really four tax brackets for long-term capital gains and qualified dividends – 0%, 15%, 18.8% (15% bracket plus 3.8% Medicare surtax) and 23.8% (20% bracket plus the 3.8% Medicare surtax). Investors in upper tax brackets should factor this additional tax into their plans to gradually sell out of position.

When planning for capital gains, taxpayers with higher incomes who are also on Medicare should also consider their income levels and how they affect monthly premiums. If you filed your 2017 taxes as “married, filing jointly” and your AGI plus tax-exempt interest was greater than $170,000, you will pay higher premiums for your Part B and Medicare prescription drug coverage in 2019. The premium jumps from the basic amount of $135.50 per month to $189.60. There are four additional income thresholds that could increase the premiums to a high of $460.50 per month.

If You’re in the Lower Income Brackets

Taxpayers in the lower income brackets will need to pay attention to another tax trap if they are receiving Social Security benefits. Retirees with AGI plus tax-exempt interest below the base amounts of $25,000 (single filer) and $32,000 (joint filer) are not subject to federal personal income tax on their Social Security benefits. Retirees with income above these thresholds will find that the tax applies to some percentage of their benefits. For joint filers with incomes above Modified Adjusted Gross Income (which includes tax-free interest) of $44,000, up to 85% of benefits can be taxed.

An investor realizing capital gains in this situation may pay 0% tax on the gain but could end up paying tax on more of their Social Security benefits. In effect, the capital gain creates tax they would not otherwise have paid.

The process of managing long-term capital gains, qualified dividends, ordinary income and tax brackets is complicated, but it shouldn’t mean investors should continue holding underperforming positions to avoid paying tax. This practice would be letting the tail wag the dog.

The goal should be to manage taxation and not to avoid taxes all together. The top tax rate on this type of investment income is 20% (23.8% when subject to the Medicare Surtax). Taxpayers are still better off paying the tax when capturing a gain then to let the gain evaporate to zero.

It is important to understand that when taxes are calculated based on taxable income, the rates are applied in this order: ordinary income first, long-term capital gains and qualified dividends second. Any available deductions are applied against ordinary income first. Long-term capital gains get stacked in a favorable manner on top of ordinary income. Deductions are applied first against the ordinary income base. Increases in ordinary income could cause the capital gains stacked on top to fall into higher tax brackets.

An effective long-term tax strategy would be to position a portfolio to place most of the income producing assets into tax-deferred accounts. This reduces taxable ordinary income allowing for future capital gains to potentially be sold at the 0% capital gains rate. Realizing capital gains in a tax deferred account has no tax implications. Unfortunately, any funds withdrawn from tax deferred accounts is considered ordinary income which does not have preferential tax treatment.

Managing marginal tax rates should be the anchor of any long-term tax planning strategy. Taxpayers should be seeking to find the optimal tax balance to fill up low current tax brackets, while avoiding being pushed into higher ones. You can read Rick’s original post on his website, here.

Rick’s Tips:

- Tax rates for long-term capital gains and qualified dividends range from 0% for the lowest tax brackets to 20% in top brackets.

- The 3.8% Medicare surtax is added to tax on capital gains and qualified dividends when a taxpayer’s income is above certain thresholds.

- An investor may pay 0% tax on capital gains but pay tax on Social Security benefits that would otherwise not been taxed.

By Rick Rodgers

Read more from Rick Rodgers by clicking here to purchase his book.

Don’t Retire Broke:

Don’t Retire Broke:

An Indispensable Guide to Tax-Efficient Retirement Planning and Financial Freedom, by Rick Rodgers

Using easy-to-understand language and real life examples, Rick teaches you how to avoid savings pitfalls and costly tax mistakes – many you may not even know about – so you can enjoy the retirement lifestyle you want.